两位分析师认为,如果要拥有成本竞争力,太阳能的单位发电成本必须减少三分之二,而只有大规模扩张才可能实现这样的目标: 我们预计,一块安装后的太阳能板将必须从今天的每瓦特4.4美元减少到每瓦特1.4美元,在成本方面才有能力与新建成的天然气发电厂发电竞争,前提是天然气发电厂必须为碳排放支付每公吨50美元的费用。而为了适应能源储存的需要,这种太阳能发电的成本还必须减少到每瓦特1.1美元。但要达到这个价位就需要大规模经济扩张。 为完全满足2025年的用电需求,需要发电大约1000万兆瓦,相当于太阳能板大概要覆盖美国佛蒙特州和新罕布什尔州全境。 但实现电网平价的成本将是天文数字,必须为此“支付数万亿美元”。

两位分析师提到了德国的经历: 大部分资金可能都会浪费。比如德国已经补贴了大约500亿美元,但太阳能只贡献了发电量的6%。边际税收在大学的研究实验室会找到更好的归宿。在那里,基础技术的突破更有可能大幅提高效率,相应地降低价格。 这并不等于说太阳能发电在全球没有存在的空间: 在缺少基础设施的印度乡村或者非洲部分地区,太阳能可能实际上是提供基础发电的最廉价方式。即使在基础设施发达的特定市场,天气最热的时候,事实可能证明,少量的太阳能发电是提供电力的有价值方式。 所以,他们的观点就是,对目前缺少发电基础设施的地区,太阳能可能是可行的,但发达世界还是忘了它吧。 Finding Economies of Scale in Solar

两位分析师提到了德国的经历: 大部分资金可能都会浪费。比如德国已经补贴了大约500亿美元,但太阳能只贡献了发电量的6%。边际税收在大学的研究实验室会找到更好的归宿。在那里,基础技术的突破更有可能大幅提高效率,相应地降低价格。 这并不等于说太阳能发电在全球没有存在的空间: 在缺少基础设施的印度乡村或者非洲部分地区,太阳能可能实际上是提供基础发电的最廉价方式。即使在基础设施发达的特定市场,天气最热的时候,事实可能证明,少量的太阳能发电是提供电力的有价值方式。 所以,他们的观点就是,对目前缺少发电基础设施的地区,太阳能可能是可行的,但发达世界还是忘了它吧。 Finding Economies of Scale in SolarPosted by Catherine Wood on Oct 8, 2012 in AllianceBernstein, Equities/Stocks | 0 comments By Catherine Wood and Brett Winton

Advocates of solar energy have argued for years that the industry only needs subsidies to gain the economies of scale that would make it cost competitive. We think that day may never arrive.

Solar power is expensive to produce because the equipment is expensive and only works a fraction of the time—30% of the time in the optimal spots for solar energy, such as the Las Vegas desert. Nuclear or coal power plants, by contrast, can run almost round the clock, day in and day out.

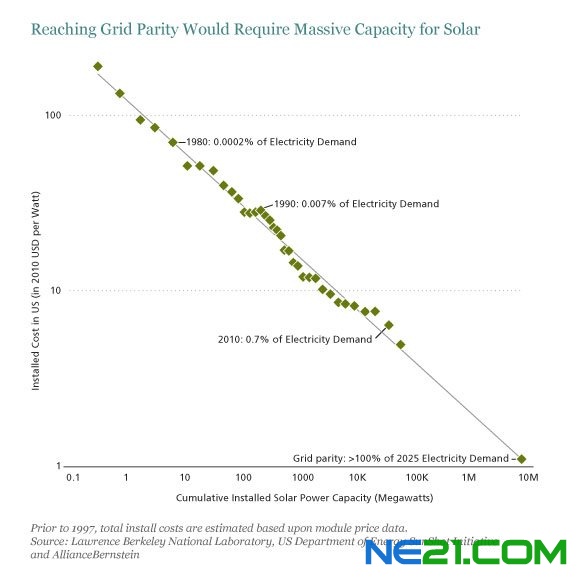

We estimate that the cost of an installed solar power panel would have to fall from about $4.40 per watt today to $1.40 per watt to become cost competitive with a newly built natural gas–fired plant, assuming the gas plant had to pay $50 per metric ton for carbon emissions. It would have to fall to about $1.10 per watt to accommodate the cost of energy storage. But to get to that price, massive economies of scale would be required.

In the power business, there’s a rule of thumb: each time you double the cumulative installed base of power-generating infrastructure, the cost of a new installation should fall by 20%. Since 1976, the cost of solar power has declined somewhat less, by 18% on average, for every doubling of installed capacity. Over the past ten years, costs have fallen 13% for every doubling.

But let’s say the cost declines return to the 18% rate. How much solar power would have to be installed before incremental solar panels would be truly cost competitive? 9.6 million megawatts, or more than 100 times the capacity in place today, as the display below shows. With an area of 20,000 square miles, these panels together would be large enough to cover Vermont and New Hampshire, and produce annual quantities of electricity sufficient to exceed demand for the entire world through 2025. So when is solar going to become cost competitive without subsidies? In three to five years? Try never. But if it did, society would have to pay out trillions of dollars to get there.

That doesn’t mean solar energy is a complete dead end. Solar power may indeed be the cheapest way to provide base electric power in rural India, or in parts of Africa devoid of infrastructure. Even in select markets with developed infrastructure, a small amount of solar power may prove valuable to provide electricity during the hottest parts of the day.

But should governments provide massive subsidies to support solar energy in places where electric power can be generated at a much lower cost?

I think not. Much of the money is likely to be wasted. Germany, for example, has subsidized the solar industry to the tune of $50 billion, yet it only gets 6% of its electricity from solar power. The marginal tax dollar would find a better home in the research labs of universities, where fundamental technological breakthroughs are more likely to yield a big increase in efficiency and corresponding decline in price.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.

Catherine Wood is Chief Investment Officer—Thematic Portfolios, and Brett Winton is a research analyst, both at AllianceBernstein.

索比光伏网 https://news.solarbe.com/201210/10/246368.html